In today’s interconnected world, where technology drives innovation and financial services, protecting your fintech from cyber threats with a comprehensive cyber insurance policy is paramount.

Fintechs and cybersecurity

In the dynamic landscape of fintech, the unprecedented opportunities for innovation are accompanied by a complex array of cyber risks. Fintech, insurtech and digital payment companies, with their reliance on digital platforms and sensitive financial data, are prime targets for cybercriminals seeking financial gain and disruption.

The risks they face are multifaceted, encompassing data breaches that compromise customer information, ransomware attacks that paralyse operations, and sophisticated phishing schemes that exploit vulnerabilities.

These events are expensive. According to IBM, the average total cost of a data breach reached an all-time high of US$4.45 million in 2023. However, cyber threats don’t only jeopardise financial stability, they also erode customer trust and can trigger regulatory scrutiny and legal liabilities.

As fintechs continue to push boundaries in redefining financial services, an unwavering focus on cybersecurity measures, robust risk management strategies, and comprehensive cyber insurance become imperative safeguards against the evolving threat landscape.

How cyber insurance can protect fintechs

Cyber insurance is crucial for fintech companies that rely heavily on digital platforms and data-driven processes to protect themselves against the escalating landscape of cyber threats.

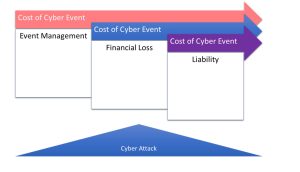

Cyber insurance plays a vital role in mitigating the multifaceted risks posed by cyber-attacks across three distinct phases: event management, financial loss, and liability.

In the event management phase, cyber insurance typically covers expenses related to incident response and crisis management, encompassing activities such as digital forensics, data breach notification, public relations efforts, and legal consultations. This facilitates swift and coordinated efforts to contain the breach and protect sensitive information.

In the financial loss phase, cyber insurance typically provides coverage for financial damages resulting from business interruption, data restoration, and loss of income due to the attack. It may also address extortion-related costs, including ransom payments, and aid in the recovery of compromised data.

Finally, during the liability phase, cyber insurance addresses legal liabilities arising from third-party claims, including privacy lawsuits, regulatory fines, and legal expenses.

This comprehensive coverage empowers companies to navigate the intricate aftermath of a cyber-attack with greater resilience, ensuring not only their financial stability but also safeguarding their reputation with customers, investors and regulatory bodies and ensuring compliance with legal and regulatory obligations.

In an era where digital trust and security are paramount, cyber insurance becomes an indispensable tool for fintech’s to thrive while minimising the potentially devastating impact of cyber threats.

What to look for in your cyber insurance policy

FinTech’s companies looking for a cyber insurance policy tailored to the unique risks they face should consider several key factors to ensure comprehensive coverage and effective protection:

- Specific coverage for financial technology risks: Look for a policy that explicitly addresses the cyber risks inherent to fintech, Insurtech, and digital payment operations. This includes coverage for financial transaction fraud, token theft, smart contract vulnerabilities, and other threats specific to your industry.

- Data breach and privacy protection: Ensure the policy covers costs associated with data breaches, including notification and credit monitoring services, as well as legal expenses arising from privacy breaches. Given the sensitive financial data involved, strong data breach coverage is paramount.

- Business interruption and loss of income: Look for coverage that compensates for lost income and extra expenses resulting from cyber incidents that disrupt your operations. Given the real-time nature of fintech services, business interruption coverage is critical to minimising financial fallout.

- Regulatory and legal expenses: Cyber insurance should cover legal defence costs, fines, and penalties resulting from regulatory actions or lawsuits stemming from cyber incidents. Compliance with financial regulations is vital for fintech companies, making this coverage essential.

- Ransomware protection: Ransomware attacks can be devastating. Ensure your policy includes coverage for ransom payments, as well as costs associated with negotiating with cybercriminals and recovering data.

- Digital asset protection (For DeFi): If you’re involved in decentralised finance (DeFi), seek coverage for digital asset theft, smart contract failures, and other DeFi-specific risks that could impact your operations and users.

- Third-party liability: Coverage for third-party claims resulting from a cyber incident, such as lawsuits from customers or business partners, is crucial to protect your company’s financial wellbeing and reputation.

- Cyber extortion: Consider a policy that provides coverage for expenses related to cyber extortion threats, which are increasingly common in the fintech space.

- Preventative measures and risk management: Some policies offer resources and incentives to help you enhance your cybersecurity practices and reduce your risk exposure. Look for policies that offer guidance on risk management and proactive measures.

- Claims handling and support: A strong claims process is vital. Choose an insurer with a reputation for efficient and supportive claims handling, including access to cybersecurity experts and legal counsel.

- Policy limits and deductibles: Ensure the policy limits align with your company’s financial exposure and review the deductible structure to determine your financial responsibility in the event of a claim.

- Tailored coverage and flexibility: Work with an insurer that can customise the policy to your specific needs, taking into account the nature of your fintech, digital payment operations.

As a specialised risk and insurance provider, Continuum is dedicated to safeguarding the digital future of pioneering fintech companies by providing comprehensive cyber insurance solutions.

We understand the intricate landscape of financial technology and the critical role cybersecurity plays in maintaining trust and operational resilience. Our expert team will guide you through the process of selecting the right cyber insurance policy and coverage options for your company’s unique risk profile. They can help you identify vulnerabilities, implement robust risk mitigation strategies, and provide insurance coverage that ensures financial security in the face of cyber incidents.

Our tailored cyber insurance offerings are meticulously designed to address the unique risks faced by fintech enterprises.

For insurance solutions that empower your business to navigate the digital realm with confidence and peace of mind, get in touch.